In a fast-track procedure at the EU Council, the Committee of Permanent Representatives (COREPER) on Friday, 27 June endorsed the provisional agreement with European parliament to simplify the carbon border adjustment mechanism (CBAM).

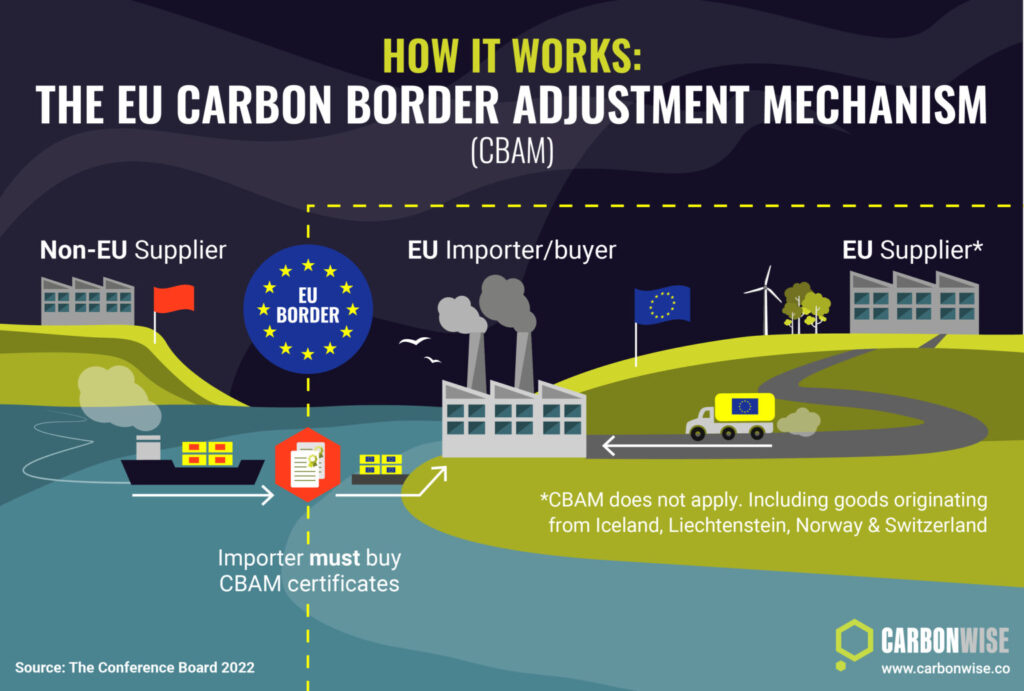

Carbon border adjustment mechanism is the EU’s tool to put a fair price on carbon emitted during the production of carbon-intensive goods that are entering the EU, and to encourage cleaner industrial production in non-EU countries.

CBAM will apply in its definitive regime from 2026, with a transitional phase currently in effect (2023 – 2025). This gradual introduction is aligned with the phase-out of free allowances under the Emissions Trading System (ETS) to support the decarbonisation of EU industry.

Threshold of 50 tonnes for CBAM goods

In earlier development on 18 June, European Commission welcomed the provisional political agreement reached between the European Parliament and the Council on the Commission proposal to simplify and strengthen the EU’s carbon border adjustment mechanism (CBAM).

Simplifications to the CBAM regulation is intended to reduce administrative burdens for businesses, while maintaining the functionality of the CBAM measure. The key aspect of the proposal is a new exemption threshold of 50 tonnes for CBAM goods. This means that companies which do not exceed a single mass-based threshold set at a level of 50 tonnes of imported goods per importer per year, are exempt from CBAM obligations.

The proposed measure will therefore mostly apply to small businesses and individuals, which import small or negligible quantities of goods covered by the CBAM regulation. As a deliverable of the Clean Industrial Deal, it is an important contribution to boost EU’s competitiveness and unlock our full economic potential and investment capacity.