Swiftly and without exceptions: that is the plan that members of the European Parliament from the Committee on Industry, Research and Energy have backed. The ban would gradually end the import of Russian natural gas over three steps over the next year. The Committee sharpened the original proposal by the European Commission opting for a full ban in the near future.

As reported by the Committee on Industry, Research and Energy (ITRE), the further tightening of anti-Russian sanctions passed fairly smoothly. Eighty-three voted in favour, nine were against, and one abstained. The same proposal will be on the agenda of the meeting of ministers of industry and energy on Monday 20 October in Luxembourg. The plenary of the European Parliament will then decide on the matter next week.

Three steps to a complete ban

Barring any unexpected changes in the approval process, the ban will be introduced gradually. Ad hoc imports are to end as early as 1 January next year. As of 17 June 2026, a ban will apply on purchases of Russian gas based on short-term contracts. From the beginning of January 2027, purchases will not be possible even on the basis of long-term contracts.

By contrast, the original European Commission proposal was more cautious, settling on a complete ban on pipeline deliveries only from January 2028. In the case of liquefied natural gas (LNG), 1 January 2027 was already suggested in the original proposal.

Under the proposed rules, European energy companies may invoke “force majeure” and terminate contracts with Russia without financial penalties. The new sanctions also target the possibility of Russia circumventing the regulations, such as declaring a false country of origin of gas or oil, the use of a shadow fleet, and transit through third countries. They introduce certification of the origin of oil and gas, which will be closely watched in the future by the European Commission.

You might be interested

Russia provoked and exploited the energy crisis

“The vast majority of members from both committees voted in favor of a strong stance on ending the import of Russian fossil fuels. I am pleasantly surprised by the shared understanding of the need for effective legislation that not only bans the import of Russian gas and oil into the European Union but is also strict in enforcement and closes loopholes in the Commission’s proposal,” said ITRE Committee Chair Ville Niinistö (Greens/FIN).

“Near-unanimous support gives a strong mandate for negotiations with the Council. The ban on Russian fossil fuels is a great success for the European Union and a turning point in European energy policy. We strengthened the original proposal of the European Commission by including oil and its products, ending long-term contracts a year earlier than proposed, adding sanctions for non-compliance, and removing exemptions for landlocked countries,” added the Chair of the Committee on International Trade Inese Vaidere (EPP/LVA).

“Europeans remember the rise in gas and electricity prices that we all experienced in 2021 and 2022. What is often called the ‘energy crisis’ is, in reality, a Russian gas shock. It was indeed Russia that exploited Europe’s dependence on Russian energy. The spirit of this regulation is simple: we will never again allow Russia to manipulate our energy market and endanger millions of jobs. Never again will Russia be able to increase the energy bills paid by European families,” noted ITRE Committee member Thomas Pellerin-Carlin (S&D/FRA).

Impact on Central Europe

The direct impact of the new sanctions on Russian fuels in the case of a country like Czechia will be zero . The Czechs ended the intake of Russian gas already in the summer of 2022; indirect deliveries via Slovak and Hungarian intermediaries continued with varying intensity until the end of last year. Imports of oil from Russia, which previously accounted for 50 to 60 percent of consumption in Czech refineries, ended in March.

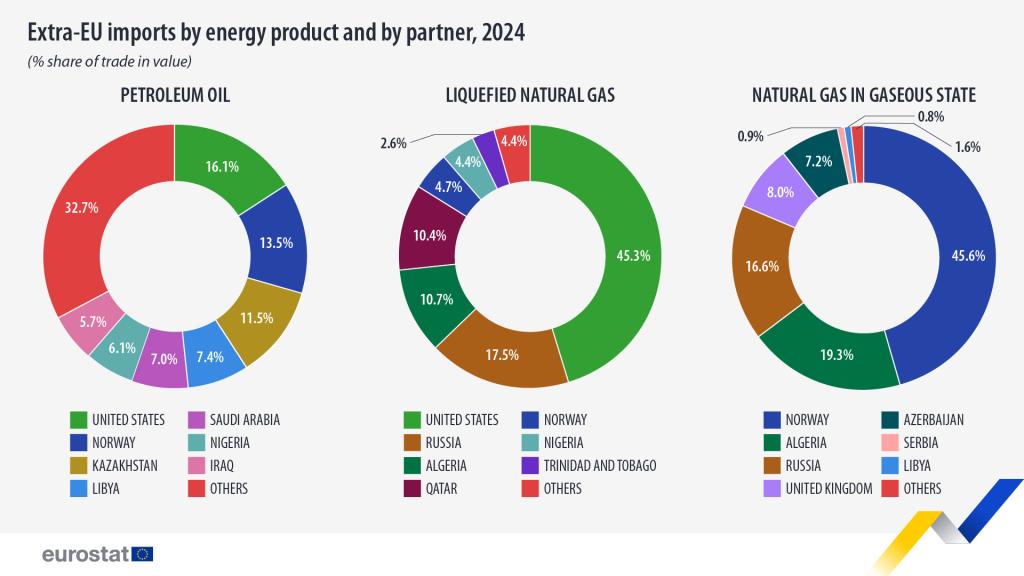

The new sanctions will mainly impact Slovakia and Hungary — two countries that still rely on supplies of oil and gas from Russia. It is from them that the strongest resistance to the proposal can be expected. Pipeline deliveries of Russian gas also head to Balkan countries. Large volumes of liquefied natural gas (LNG) from Russia are mainly taken by France, Belgium, and Spain; indirectly, the Germans also purchase it via the French terminal in Dunkirk.