The Dutch government took an unprecedented step last week by removing the CEO of chipmaker Nexperia, a subsidiary of the Chinese conglomerate Wingtech Technology. Officials cited serious governance failures that could threaten Europe’s economic security. The move has reignited concerns about Europe’s growing dependence on China for critical technologies and supply chains.

In retaliation, Beijing imposed a ban on Nexperia’s exports from China, sparking alarm across the European and American automotive industries about a potential shortage of vital semiconductors. On Wednesday, Volkswagen did not rule out that it would have to temporarily reduce production due to the problem.

Zhang Xuezheng, the now former CEO of Nexperia, was forced to resign after an investigation by the Dutch Ministry of Economic Affairs and the Enterprise Chamber found significant managerial misconduct. According to the Chamber, Mr Zhang orchestrated transactions in which Nexperia purchased overpriced components from financially struggling companies in which he held a personal stake.

The Dutch government based its intervention on the Goods Availability Act, a Cold War-era law designed to secure access to essential goods. Although the law had been on the books since 1952, it had never been used before.

You might be interested

A quick retaliation

Beijing reacted shortly after the Dutch announcement. The Chinese government, angered by what it perceives as political interference, imposed an export ban on Nexperia’s Chinese operations. This move effectively halts shipments of “standard” automotive chips from Nexperia’s large Chinese production facilities to Europe. Few days ago, tensions further escalated: Nexperia’s China department informed local employees to disregard instructions from the chipmaker’s Dutch headquarters.

Nexperia has opened negotiations with Chinese authorities to lift the ban, while the Dutch government is in close contact with the European Commission to coordinate a response.

On Tuesday 21 October, Dutch (outgoing) economy minister Vincent Karremans indicated to have discussed “further steps” with Wang Wentao, Chinese minister of commerce. “In the coming period, we will remain in contact with the Chinese authorities to work toward a constructive solution,” the Dutch Minister posted on X.

Systemic dependence on China

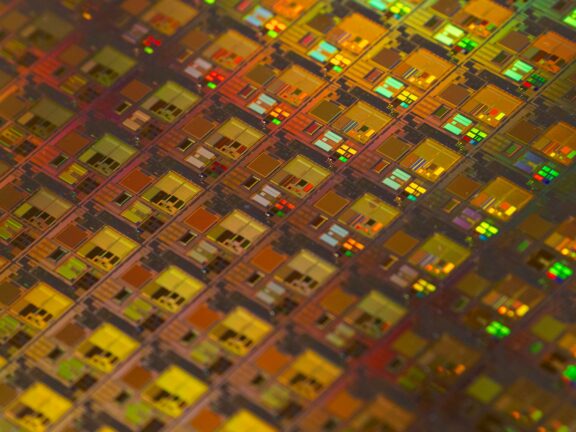

Europe’s reliance on China for semiconductors and, more broadly, for upstream supply-chain nodes such as raw materials, advanced packaging, and mature-node chips has become a major strategic vulnerability. While the European Chips Act, launched in 2023, aims to increase the EU’s share of global chip manufacturing to 20 per cent by 2030 and reduce external dependencies, the bloc remains heavily exposed. China continues to dominate several critical segments, including raw materials, manufacturing equipment, and certain mid-range chip technologies.

Recent disruptions, such as Beijing’s export ban on Nexperia, have underscored how easily these dependencies can ripple through Europe’s automotive, defense, and green-tech industries. The EU has made progress by designating new “Integrated Production Facilities” and “Open EU Foundries” to boost domestic production capacity.

Still, member states now concede that stronger coordination is necessary. In October 2025, EU governments jointly called for a “Chips Act 2.0” to strengthen design capabilities, advanced packaging, and strategic autonomy across the continent.

Repurcussions felt across Europe

If anything, the Chinese response shows that it is Beijing who has the upper hand in the situation, as Nexperia’s former-CEO Frans Scheper put it in a Dutch newspaper. Indeed, repercussions of the conflict are being felt across Europe.

The European Automobile Manufacturers’ Association (ACEA) has voiced its concerns: “Automakers have taken steps over the last years to diversify supply chains but risk cannot be mitigated down to zero. This is a cross-industry issue affecting a large number of suppliers and virtually all of our members” said ACEA general director Sigrid de Vries in a statement. “We suddenly find ourselves in this alarming situation. We really need quick and pragmatic solutions from all countries involved,” she said. ACEA is likely to have but several weeks of Nexperia-chips stock left.

On 21 October, German tabloid Bild reported that Volkswagen was ready to suspend production of major models, including the Golf at its Wolfsburg plant, due to the chip shortage.

Modern vehicles now incorporate between 1,000 and 3,000 semiconductors depending on the model. Car manufacturers can turn to alternative suppliers, such as the American semiconductor producer Texas Instruments. This may provide some relief, but cannot cover the full shortfall.

A question of strategy

Dutch authorities have feared for some time that Nexperia’s Chinese mother company, Wingtech, would ultimately move the production to China. The issue expands beyond Nexperia; Dutch intelligence services have warned the potential loss of the chip sector productions to be a national security risk, given the strategic importance of the chipsector.

We suddenly find ourselves in this alarming situation. We really need quick and pragmatic solutions from all countries involved. — Sigrid de Vries, Director General of ACEA

This is why the decision by the Dutch government to intervene in such stark terms has raised strong criticism. Political and economic commentator Arnaud Bertrand, for example, called the move ‘profoundly dumb’: “By doing so, not only they’re killing the assets in question, but the most important industry on the continent, too,” Mr Bertrand stated on X.

As reported in other media, the Hague’s unexpected move came amidst pressure from the US administration to “get tough on China”. “It is not easy to be European these days,” Wednesday’s Bloomberg article editorialised. It would be difficult to disagree.