An overt American strike on Iranian nuclear and command sites in the coming weeks would yank the European Union—you guessed it—into a fresh set of crises. The following paragraphs provide a primarily economic assessment of what such an attack would do to EU policymaking. For the rank-and-file European, it is obvious: omnipresent chaos and costliness.

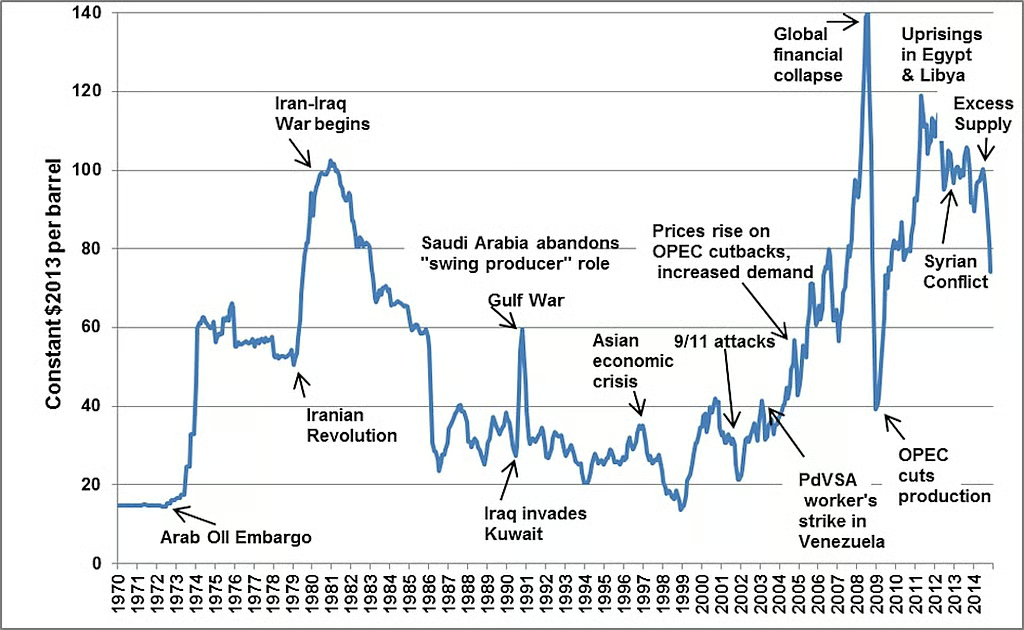

When wars rage outside of your territory, energy security is likely to be one of your biggest problems. About a tenth of the European Union’s crude still squeezes through the Strait of Hormuz. The first missiles will send war-risk premia soaring and push many tankers round Africa. Brent crude shoots from roughly $88 to somewhere between to $120 and $140 a barrel within days, pricing in lost time and menace rather than any material losses. What happens next is not pretty.

Gas follows oil upward. Dutch Title-Transfer Facility futures might jump by a quarter to two-fifths even though no pipe links Iran to Europe. Traders begin to hoard dollars; the euro could sag by three percent. Continental equities lurches lower, with the European index STOXX 600 perhaps surrendering as much as a tenth in the opening week.

Energy bites

New share issuances stop in their tracks. History shows such shocks travel fast through contracts. Within a month airlines, shippers and road hauliers find themselves paying above-trend fuel bills; by late spring chemical, metal and fertiliser plants have swallowed double-digit rises in feedstock costs.

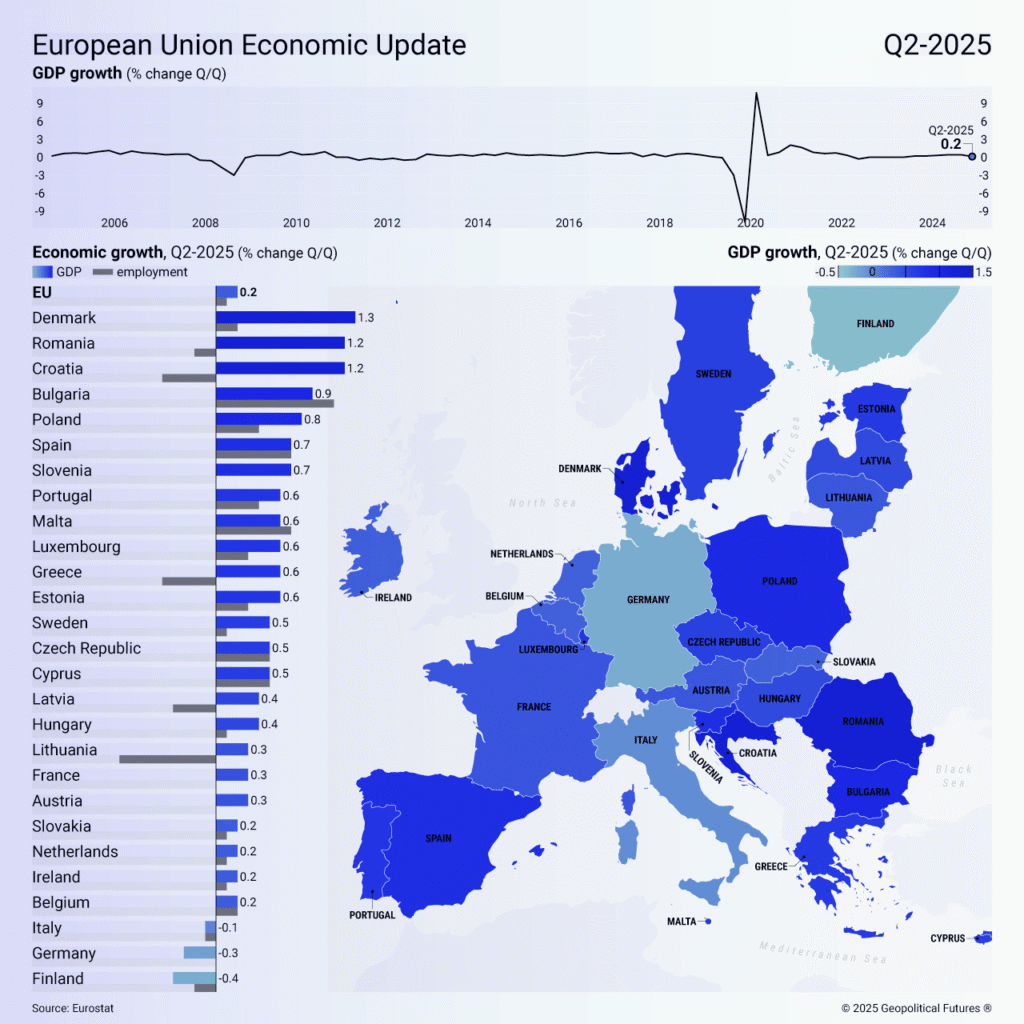

Manufacturing managers signal distress. Their indices might slip below 50 for two successive quarters, prompting economists to peel roughly 0.4 percentage points from the Commission’s 2026 growth baseline and leave EU-27 expansion near 0.9 percent. The blow stings hardest in Germany, Italy and Poland, each tethered to hydrocarbons for heavy industry, while France and Spain will find partial relief in nuclear and renewables.

You might be interested

Higher energy costs reignite inflation. Headline consumer-price index, expected to sit just over 2.2 per cent, could rebound over 3.0-to-3.5 per cent by the third quarter, wiping out much of 2025’s disinflation. Food grows dearer, yet again, once costlier fertiliser filters into wheat and meat prices.

Oil majors thrive. TotalEnergies, Eni and the European arms of BP are set to bank windfall profits, gifting treasuries an awkward revenue bump. Elsewhere, costs mount. Rerouting round the Cape adds up to two weeks to Asia-Europe sailings and lifts freight rates by roughly a fifth. Bavarian car plants and Emilia-Romagna designers have to chase components stuck at sea. Exporters of luxury trinkets to Gulf monarchies could lose up to eight per cent of annual sales if regional shoppers purse their lips.

Supply-chain strain

Secondary American sanctions hit next. Brussels may well dust off its Blocking Statute, which forbids compliance with extraterritorial penalties, yet banks remember the fines levied after Washington quit the nuclear pact in 2018. Many still back away from Iranian-linked business, raising trade-finance costs and slowing any payment tagged with a Tehran address. Compliance budgets can swell even at firms with no Iranian exposure, chilling investment across the board.

The sudden weakness of the euro inflates the import bill further, while bond investors will watch Italian spreads widen until the European Central Bank has reacted. Frankfurt would oblige. The Governing Council would postpone any rate cuts until at least the final quarter of 2026 and enlarge the Transmission Protection Instrument to cap periphery yields. Pandemic-era asset holdings would keep rolling into Italian and Spanish debt to head off fragmentation.

Treasuries are to reopen spreadsheets, too. Around €20-25 billion of unused RePowerEU cash could underwrite energy rebates for households and vouchers for small energy-intensive firms. Energy ministers may promise a joint release of up to 30m barrels from strategic reserves and revive a voluntary ten-per cent gas-saving scheme. The European Parliament is likely to cry for a ‘Crisis Energy Bond‘ worth perhaps €100bn. Frugal governments in The Hague and Vienna grumble yet feel the pressure rise in step with utility bills.

Fiscal firewalls

Budgets shuffle. Their engineers steer €5-7bn toward hydrogen and LNG import links, accelerate permits under the TEN-E system and push forward the Ten-Year Network Development Plan (TYNDP) on guidelines for trans-European energy infrastructure. The TYNDP identifies priority corridors and areas for electricity and gas infrastructure development across member states to enhance energy security, integration, and sustainability, supporting Caspian and Mediterranean gas and green-hydrogen lanes.

Trade officials are likely to tighten dual-use export rules inside thirty days to match updated American blacklists while stressing Brussels’s autonomy. Any possible resurrection of INSTEX, a European trade channel with Iran closed in 2023, is off the table indefinitely.

Industrial strategists seize the moment. An amended Net-Zero Industry Act courts domestic refining and petrochemical projects, arguing that shorter supply chains equal sturdier security. Defence hawks in Poland and Denmark demand that a slice of energy windfall taxes feed the European Peace Facility, though budget committees might stall any shift until 2027.

National measures diverge. Berlin could extend its 2022 cut-price fuel excise into 2027, at a cost of €8bn. Paris, once again, urges an EU-wide fuel cap, irritating eastern capitals wedded to market prices. Rome presses Algiers to speed a new pipeline, while Warsaw and Baltic partners juggle trade pain with heftier defence bills.

Strategic paddling

If missiles fly, Brussels is likely to move beyond economics within hours. The Foreign Affairs Council meets by video. High Representative Kaja Kallas condemns what she might call “escalatory action on all sides” and trigger the Integrated Political Crisis Response mechanism. Activation spins up the Military Planning and Conduct Capability crisis cell, granting the necessary political blessing to a beefed-up EMASOH mission. The later includes the France-led AGENOR flotilla, with Italy and Greece perhaps lending frigates. The goal is to flaunt a visible—if limited—power-projection to keeps tankers moving, all without endorsing American strikes.

Within a month defence ministers can front-load €1bn from the European Defence Fund on air-defence and anti-drone gear. Germany, Poland, and Sweden may announce joint Patriot and IRIS-T ammunition buys through the new EDIRPA joint-procurement scheme.

Crises often accelerate dormant integration; academics note they act as punctuation moments. The Strategic Compass review, due mid-year, debates a pre-agreed maritime chokepoint concept, and a June NATO–EU declaration salutes EU naval patrols in the Gulf even as missile defence stays squarely under the Alliance.

All this heaps problems insurmountable in peacetime. Messaging needs unanimity, while Poland and Czechia will push to soften any hint of moral equivalence between Washington and Tehran.

Creaky unity

Yet compromise might emerge. The Council can deplore Iranian retaliation and American unilateralism in equal measure and call for a quick United Nations mechanism. The EU-27 would name a senior figure (Helga Schmid, fomer EEAS and OSCE chief, springs to mind) as special envoy to commute among Tehran, Washington and Gulf capitals.

Sanctions expand but not mirror those imposed by the US. An IRN package may list 18 Revolutionary Guard commanders and missile suppliers, widening export bans to avionics and semiconductor tools. Brussels is likely to stop short of secondary sanctions on Chinese refiners, keen to keep its humanitarian pipeline open, aligning with Brookings prescriptions for European leverage.

The episode also exposes long-standing political fractures. Atlanticists cheer American resolve; law-minded neutrals mutter about precedents. Greece, Cyprus and Spain will focus on escorting merchant ships. Ireland and Austria are likely to cite their own neutrality and UN legality. Hungary could brandish a veto to do what it does best, i.e., blackmailing everybody in the room. Unity creaks, and each creak echoes in bond spreads.

Much depends on limits. These projections assume Washington keeps its strike short and Tehran avoids sealing Hormuz for too long. Should Iran persist with proxy attacks or a prolonged blockade, Brussels faces a familar dilemma: Either deploy hard power it still lacks or lean further on the very ally whose unilateral action triggered the crisis.