The European Commission has seen a sharp surge of Chinese products entering the European market over recent months. Industrial robots and chemical products stand out: certain chemicals are imported dozens of times more than a year ago. Meanwhile, prices of these products have dropped significantly, risking unfair competition and threatening European businesses.

Since the United States imposed high tariffs on Chinese goods in early April, imports of Chinese goods to the US decreased by 20–25 per cent. Within the EU, concerns have grown that Beijing is now redirecting its products to Europe at low prices to maintain sufficient access to consumer markets.

The European Central Bank warned that the US-imposed tariffs will therefore deepen the EU-China trade imbalance and could reduce euro-area inflation by as much as 0.15 percentage points. The UK-based Centre for Economic Policy Research (CEPR) even estimates this effect at 0.3 percentage points over the course of two years, saying that the technology sector will suffer most.

Immediate effect

That effect was indeed observable immediately. According to Sea-Intelligence Maritime Analysis, carriers reported an all-time high in capacity sailing from Asia to Northern Europe in April, at 411,600 Twenty-foot Equivalent Units (TEUs; the standard unit of volume used in the shipping industry), surpassing the previous record set in March 2021. Overall exports from the EU to China rose by around 10 per cent in recent months.

As this surge of Chinese products may threaten fair competition and put EU industries at a disadvantage, the Commission set up an import surveillance task force in April. The data should provide insights and help protect the EU market. “This is a new ‘China shock’,” Commission President Ursula von der Leyen said at the G7 meeting in Canada in July. “As China’s economy slows, Beijing floods global markets with subsidized overcapacity its own market cannot absorb.”

You might be interested

The Commission data shows that the most significant increases from China concentrated in five sectors: textiles, chemicals, mechanical engineering, the metal industry, and wood/paper. The most recent data shows that for example, some chemicals, including chlorprothixene (INN) and thenalidine (INN), were part of China’s imports 36 times more frequently than last year, with prices 95 per cent lower.

Import tariffs imposed

In some cases, the Commission has already taken responsive measures. In July, it imposed duties of 21.3 percent to 36.1 per cent on imports of assembled parquet flooring, which are find their use in spaces like offices, shops, and private homes. That category saw a more than tenfold increase and a 77 per cent price drop compared to last year. The Commission says the measure should protect more than 10,000 European jobs in an industry that’s worth €1.3bn.

In August, the Commission also imposed import tariffs on decor paper from China, a sector that provides employment for over 2,000 people in the EU. Duties range from 26.4 to 26.9 per cent and took effect after the data showed that those imports enjoyed ‘dump prices’ in the EU, which harms the internal European industry.

While the Commission frames its decisions as measures to protect European industries, a Dutch manufacturer of multiplex, classified under parquet flooring, highlights another perspective. In an interview with the Dutch public broadcaster NOS, De Gouw Handelmaatschappij argues that the measure will push consumer prices higher. On top of that, European producers face operational constraints, and domestic production alone cannot meet current demand.

Industrial robotics

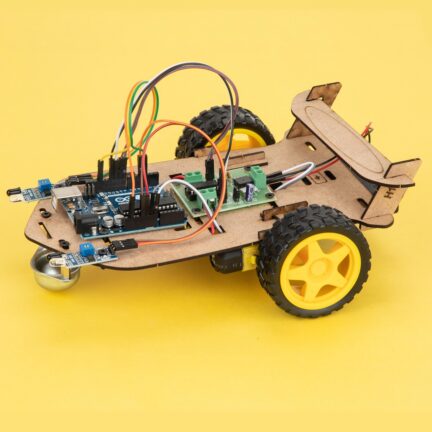

Another sector experiencing import surges is robotics. Industrial robots, in particular, saw imports rise by 315 per cent in a year, with an average price drop of 29 per cent. The robotics sector’s prominence is no coincidence. Robotics is one of the ten core sectors in China’s “Made in China 2025” strategy. Backed by cheap loans, state support, subsidies, and tax incentives, Beijing has fueled rapid growth: by 2024, China had over 451,000 companies in advanced robotics, three times the amount in 2020.

Overproduction and domestic price wars have pushed Chinese firms to offload goods abroad, raising fears of structural disruption in European markets. Today, China produces more robots than Germany, South Korea, Japan, and the US combined.

Last weekend, Beijing hosted the first World Humanoid Robot Games, showcasing the government’s focus on humanoids as a cornerstone of national strategy. According to the International Federation of Robotics, the government wants to show its competence and global competitiveness in this field. In March, China also announced a one-trillion-yuan fund (€119bn) to support technology startups, including in robotics and AI.