Europe’s push for strategic defence autonomy has a continent-sized problem. When it comes to securing critical raw materials, the Union is lagging behind not only the US and China, but also Canada or Australia. Alena Kudzko, head of the GLOBSEC US Foundation spoke to EU Perspectives about how to fix it.

European involvement in the extraction of raw materials, vital components of modern military equipment, does not create colonial-like dependencies, as many in the Union worry. There are many safeguards in place. “The issue is that others are moving much faster. In both Ukraine and Greenland, but also other parts of the world, the EU is not the fastest mover,” Alena Kudzko, Executive Director of the GLOBSEC US Foundation told EU Perspectives.

Structural disadvantages

Other major global players have much more developed strategies and projects worldwide, and have more advanced industries that work across the supply chains of critical minerals. “Europe actually faces structural disadvantages in securing access to critical materials in Ukraine and Greenland compared with actors like the US, China, or Australia,” Ms Kudzko said.

The EU moves slower. The bloc took a major step toward addressing these gaps in its last legislative term with the adoption of the Critical Raw Materials Act, aimed at boosting domestic extraction, refining, and recycling capacities while reducing dependence on third-country suppliers. Yet, many fear that is ot enough.

Investment approval, permitting, and environmental procedures are still fragmented across member states, while tools like the European Investment Bank and Global Gateway are still cautious about early-stage, high-risk mining projects. According to Ms Kudzko, the US and China deploy faster financing and projects far more aggressively, often securing first-mover positions in new deposits.

You might be interested

The materials in question are essential for the defence industry but also to build any modern electronics devices. The rare earth elements are used in guidance systems, radars, and electric drives; tungsten and titanium in armor and jet engines; lithium and cobalt in military batteries and drones. “An F-35 aircraft, for example, contains more than 400 kg of rare earth materials. If you don’t have access to these materials, you cannot produce modern defense equipment,” the GLOBSEC functionary warned. The US-based foundation she leads strives to enhance security, prosperity and sustainability throughout the world.

Security, or neo-colonialism?

Everyone wants to be sure about their own security. The EU is slow “building refining, processing, and industrial capacity close to the source, under transparent and environmental standards” in Ukraine as well as in Greenland, Ms Kudzko listed the bottlenecks. Meanwhile, China “not only controls deposits, it also controls refining and processing of these materials”.

Today, over 90 per cent of all rare earth materials are processed by Beijing. “To make things even worse, China also has the most efficient technology on producing components like for example magnets from these materials,” said the GLOBSEC official.

The EU is trying both in Ukraine and Greenland, “to reduce dependency on authoritarian suppliers while strengthening partners economically. Security comes from interdependence among allies, not control over others’ resources,” Ms Kudzko stressed. “In Ukraine, the goals are to link Ukraine’s resource potential with European industrials, technologies, and manufacturing capacity to create mutual benefit: Ukraine gains investment, standards alignment, development of local industries, Europe gains secure access under trusted governance and helps European industries add more value across the supply chains.”

Due diligence required

Also, projects enjoying support by European institutions and the EU must meet environmental, labor, and transparency standards such as “financing through the European funds also requires due diligence and anti-corruption compliance” but also “geological mapping and processing plans, which the national agencies develop. These mechanisms ensure that cooperation strengthens partners rather than replicates extractive dependencies.”

Greenland is not a future property of the EU, just as it will not belong to the US.” — Jens‑Frederik Nielsen, Greenland’s Prime Minister

Ukraine holds some of Europe’s largest undeveloped reserves of a couple dozen different types of materials that the EU classifies as critical — for example, lithium, titanium, and rare earths. These are essential for batteries, aerospace components, and military technologies. Many Ukrainian resources are underexplored or are in the early stages of development.

According to Ms Kudzko, the goal for Europe is not to ‘own’ them but to integrate Ukraine into the European raw materials value chain – through investment, transparency, and strategic partnerships – to reduce dependency on third countries and strengthen both sides’ security. The EU’s interest isn’t about ownership but about long-term access and alignment — helping Ukraine develop these resources under European standards and partnerships, instead of them being captured by Chinese or Russian investors.

Partnership with Nuuk

The EU signed a strategic partnership agreement on critical raw materials with Ukraine in 2021, “but the agreement has not been progressing much (including because of the war) and a lot needs to be done to ensure practical implementation. In general, the idea is to build joint value chains—not simply extract raw ore—so Ukraine becomes part of Europe’s industrial base,” she added.

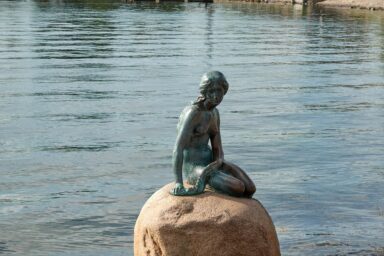

“Greenland is not a future property of the EU, just as it will not belong to the US,” Jens‑Frederik Nielsen, Greenland’s Prime Minister told the European Parliament’s plenary earlier this month. Greenland holds some of the largest underdeveloped reserves of rare earth elements outside China, as well as nickel, cobalt, and graphite.

Political legitimacy is as important as commercial viability. — Alena Kudzko, GLOBSEC US Foundation head

These materials are essential for clean energy, defense systems, and advanced electronics. “The EU’s interest is not in ownership but in strategic partnership that is ensuring that future projects align with European environmental and governance standards”, Ms Kudzko said about EU strategy on the world’s largest island.

What (not) to do

For GLOBSEC, mining and processing projects do often raise concerns about governance, environmental impact, and local benefit. “Mining and processing projects risk being as extractive if most value goes out of the host country. Environmental safeguards can also be difficult to enforce. Finally, local expectations—from community consent to revenue sharing—mean that political legitimacy is as important as commercial viability,” the GLOBSEC officer said.

To address these risks, the EU must ensure its partnerships are transparent, co-owned, and bring tangible benefits on the ground that means “supporting local processing capacity, strict adherence to environmental and labor standards, and public disclosure of investment terms. Financing should be faster and tied to measurable social and industrial outcomes,” she concluded.